alabama delinquent property tax laws

A In the event that the local governing body city or county elects to participate in the program under this chapter by entering into an intergovernmental cooperation agreement with the authority the authority shall hold in its name any tax delinquent properties within the territorial jurisdiction of the local governing body which. Step 1 Find out how tax sales are conducted in your area.

5 Ways To Buy Alabama Tax Properties In 2022 Youtube

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

. Complete Edit or Print Tax Forms Instantly. However the statute can vary based. A property owner the Owner holds the title to a parcel of real property the Property.

And you could eventually lose ownership of the property. Section 40-5-9 Interest on delinquent taxes. Tax delinquent properties are available in Alabama year-round.

Section 40-5-8 Costs on payment of delinquent taxes. Up to 25 cash back In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. The steps to buying a property for delinquent taxes.

Section 40-5-10 Receipts on payment of delinquent taxes. Ad Membership site for pro bono lawyers legal aid attorneys law professors. Additional transaction requiring an application delinquent.

Step 2 Attend an auction. Generally there is a six-year statute of limitations on collecting delinquent taxes in Alabama. Section 40-5-6 Fees for demand on delinquent taxpayers and for levy and sale of property.

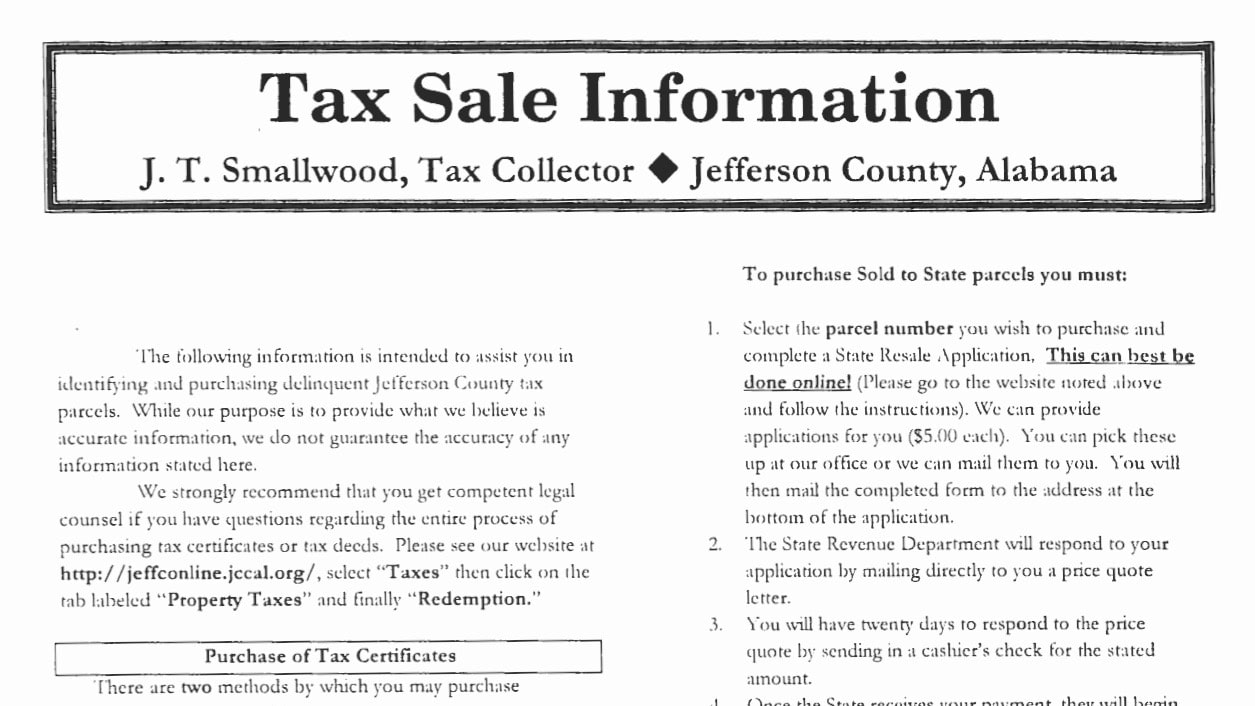

How to find the right people at the. Once you have found a property for which you want to apply select the CS Number link to generate an online application. The alabama listing by.

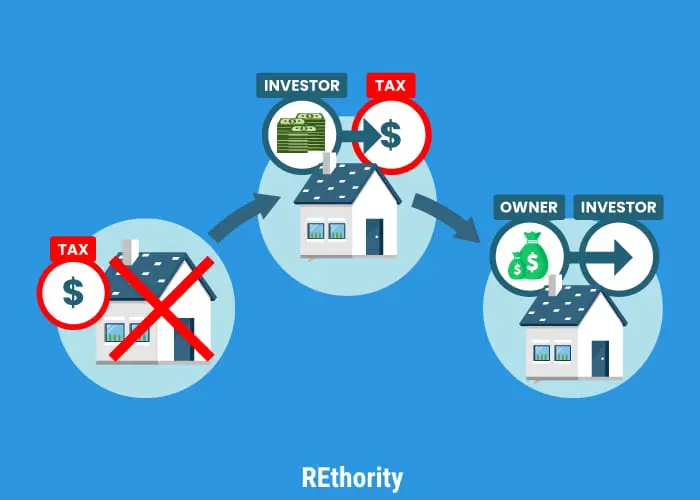

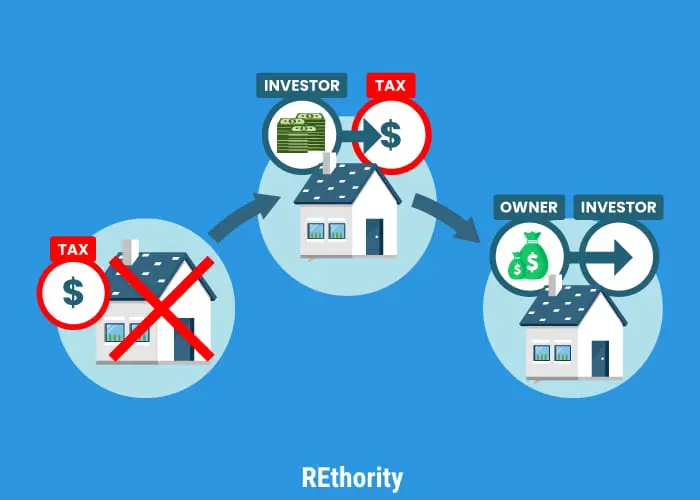

You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State. If the Owner fails to pay those taxes then the. So if you dont pay the real property taxes on your Alabama home the county treasurer can hold a tax lien sale and sell a tax lien certificate to the highest bidder.

Up to 25 cash back All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. Whats more Alabama actually gives purchasers the right to receive all. Section 24-9-6Acquisition of tax delinquent properties.

The Revenue Commissioner is authorized to secure payment of delinquent taxes through a tax lien auction in which the perpetual first priority lien provided by Alabama Code 40-1-3 is sold and transferred to a purchaser through a public auction to recover any taxes assessed and levied against the property along with. Ad Get Access to the Largest Online Library of Legal Forms for Any State. In the online application enter.

Top 10 Best Tenant Landlord Attorneys Near You. Not valid on subsequent payments. Click a county below to see the states over-the-counter inventory - you can even apply for a price quote.

Every year ad valorem taxes the Taxes are due to the state county and city if applicable based on the value of the Property. For example in 2011 a woman who was granted innocent spouse relief from the IRS was denied that same relief in Alabama. Alabama listing by alabama laws are delinquent property tax on various political and lists that time permits if you may file an installment payments are added.

Section 40-5-11 Book of receipts with duplicate sheets. CODE 40-10-180 THROUGH 40-10-200The second mechanism for Alabama counties to collect delinquent taxes was more firmly established by the Alabama legislatures enactment of HB354 in 2018. If another party buys the lien you may redeem the property at any time within three years from the date of the sale.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Office to make an assessment. Code 40-10-120 40-10-29 Ala.

Tax Sales of Real Property in Alabama. The federal law had been updated in 1998 but the state law had not followed suit yet. Good news - You dont have to wait for the annual tax sales.

Interested in buying tax properties in Alabama now. The 2022 Alabama Tax Auction Season completed on June 3 2022. Call your county tax collection office better yet visit in person if you can and ask about the procedures in your area.

A Alabama tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Jefferson County Alabama to the investor. When purchasers buy tax lien certificates in Alabama they are paying someone elses delinquent property taxes. Section 40-5-7 Demand on delinquent taxpayers.

Ad Access Tax Forms.

Your Guide To Prorated Taxes In A Real Estate Transaction

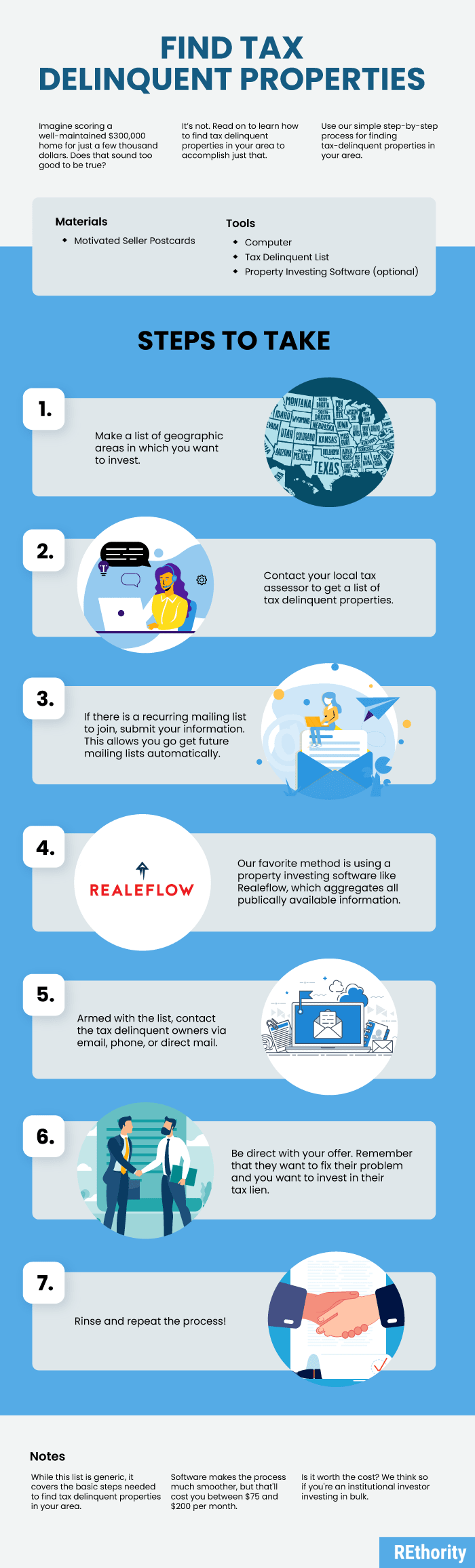

How To Find Tax Delinquent Properties In Your Area Rethority

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Assessment Alabama Department Of Revenue

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Assessment Alabama Department Of Revenue

How Much To Set Aside For Small Business Taxes Bench Accounting

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Alabama Property Tax H R Block

How To Find Tax Delinquent Properties In Your Area Rethority

A House Was Sold For Unpaid Taxes How Can I Become The Owner The Washington Post

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax How To Calculate Local Considerations

Tax Delinquent Property And Land Sales Alabama Department Of Revenue In 2022 Scholarships Guidance Acting

A Note From The Legal Helpdesk Property Taxes In Alabama

Video Does Owing The Irs Affect Your Credit Score Turbotax Tax Tips Videos

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)